ev charger tax credit 2020

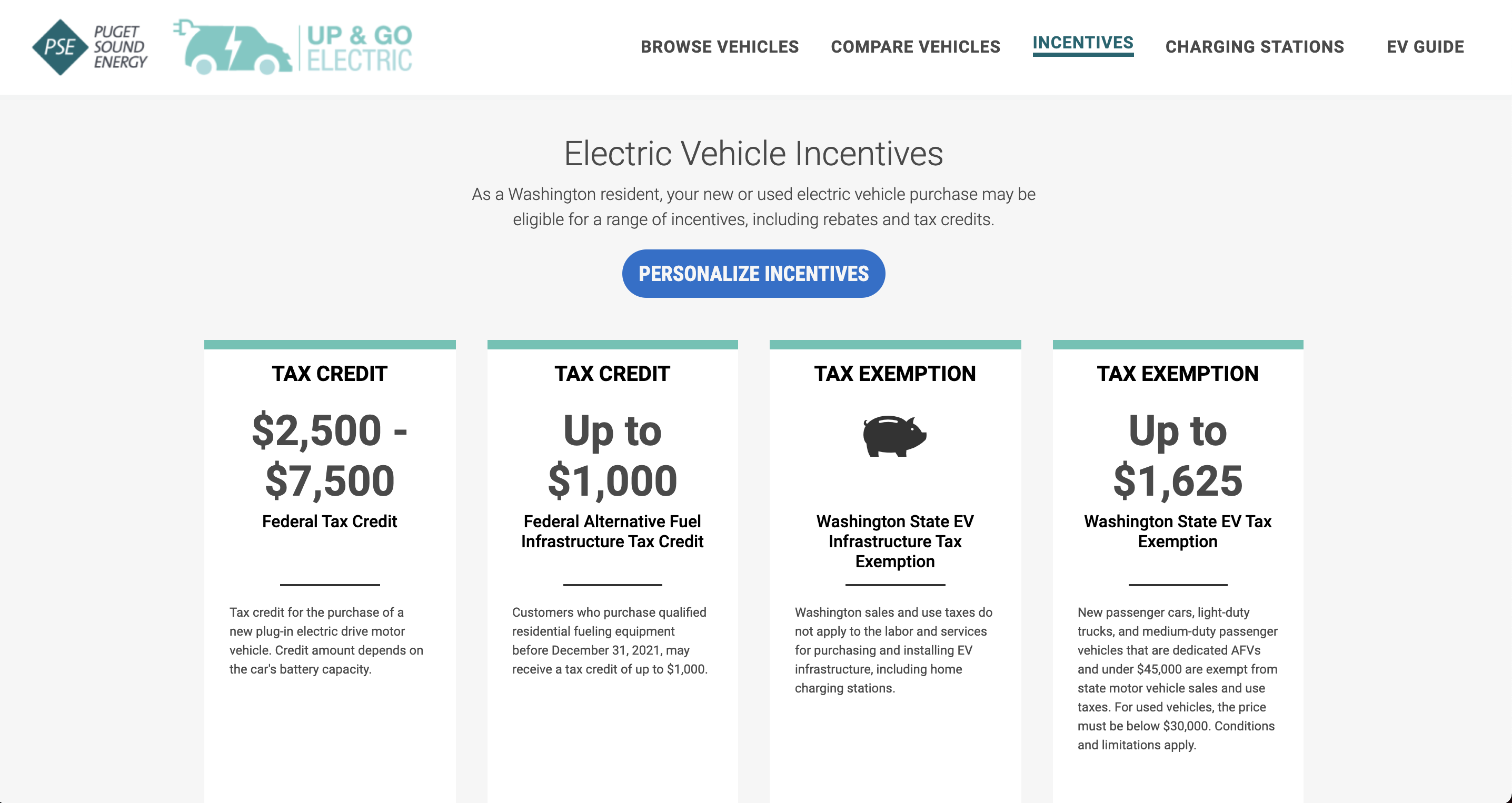

The credit amount will vary based on the capacity of. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Charge At Home Holy Cross Energy

A federal tax credit of 30 of the cost of installing ev charging equipment which had expired december 31 2016 has been retroactively extended through december 31 2020.

. Compare Homeowner Reviews from 8 Top Nutley Electric Vehicle Charging Station Installation services. If you installed electric vehicle charging equipment after January 1 2017 or you install it before December 31 2020 you may be eligible for a Federal Tax Credit of 30 of the. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022.

Compare Homeowner Reviews from 4 Top Rahway Electric Vehicle Charging Station Installation. However i cant find any evidence of this being valid past 123121. Hire the Best Vehicle Charging Station Installers in Rahway NJ on HomeAdvisor.

Narcise CPA is the partner in charge of the Real Estate Construction Services Group specializing in all areas of accounting audit and tax for family. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. If your system was installed between 2006.

In 2022 President Bidens Build Back Better infrastructure bill. Sales of electric vehicles continues to grow through 2022 and 2023 as more options are given to consumers. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations with.

However i cant find any evidence of this being valid past 123121. If your solar panels were installed after January 1 2022 you may qualify for the newly increased 30 tax credit under the Inflation Reduction Act. Ev Home Charger Tax Credit 2020.

Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. Hire the Best Vehicle Charging Station Installers in Nutley NJ on HomeAdvisor.

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Senate Reaches A Deal Regarding Ev Tax Credits Sought By Tesla Toyota Dsj Cpa

Ev Charging Tax Credit Returns Retroactive Ev Support

Up To 1k Tax Credit For Ev Home Charging Station R Boltev

Ev Tax Credit How Electric Car Owners Could Reap Benefits Of Inflation Reduction Act Gobankingrates

How To Take Advantage Of Ev Charging Infrastructure Tax Credits

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Ev Charger Federal Tax Credit Is Back Kiplinger

What To Know About The Federal Tax Credit For Electric Cars Capital One Auto Navigator

Federal Charging And Ev Incentives Chargepoint

How To Find Ev Infrastructure Tax Credits Ev Connect

Electric Cars Will Challenge State Power Grids The Pew Charitable Trusts

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Every Electric Vehicle Tax Credit Rebate Available By State